|

comparing pet health insurance plans with clear eyesI want proof more than promises. Brochures beam; policies decide. The trick is separating marketing comfort from real coverage, then choosing what kind of pain you can live with when the bill hits. Start with your pet, then your riskAge, breed tendencies, and your cash cushion matter. If a midnight emergency would push your budget off a cliff, insurance shifts the shock. If you've got savings and a low-risk pup, a higher deductible might make sense. Location changes premiums, too, and not by a little. - Age: young is cheaper, but premiums rise; some carriers limit new enrollments for seniors.

- Breed risk: hips, backs, brachy issues - insurers price them in.

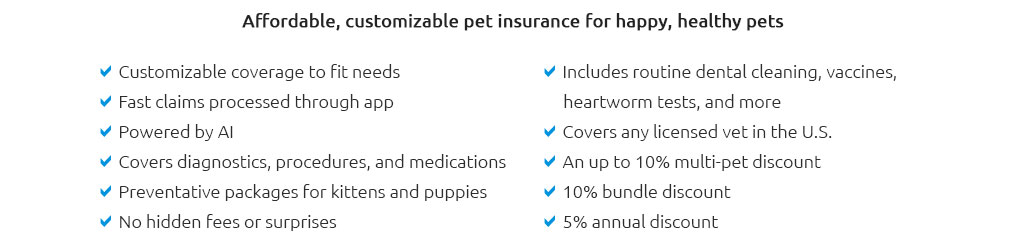

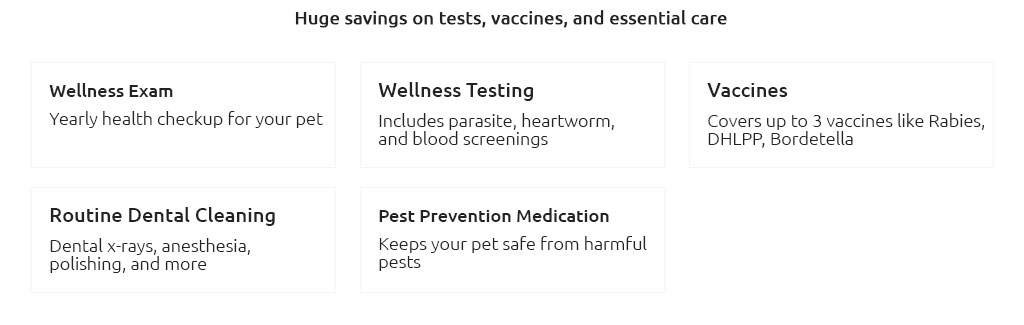

- Plan type: accident-only, accident+illness, wellness add-ons; the add-ons rarely "pay for themselves."

- Deductible style: annual vs per-incident changes how often you start from zero.

- Reimbursement: 70 - 90% seems close until you apply it to a big invoice.

Coverage scope: what's in, what's quietly outRead the policy, not the highlights. Accidents are straightforward; illness is where exclusions live. Dental disease and behavioral care are often trimmed. Prescription food is usually no, unless therapeutic and explicitly listed. - Waiting periods: accidents short; illness longer; cruciate/hip can be longest.

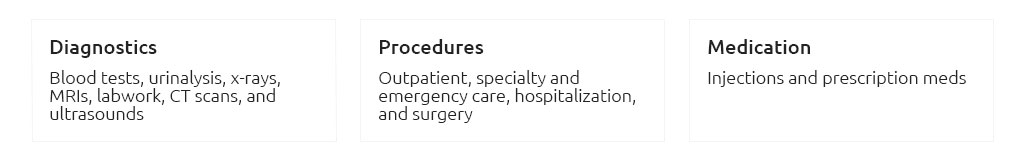

- Diagnostics: imaging and labs can be covered - or not - if tied to an excluded condition.

- Exam fees: some plans exclude them; that stings on each visit.

- Holistic/rehab: sometimes covered with limits; check per-visit caps.

Exclusions that bite later- Pre-existing: any sign or symptom before start or during waiting periods can be excluded permanently.

- Bilateral clauses: one knee today can exclude the other tomorrow.

- Chronic caps: lifetime or per-condition limits can cut off help mid-journey.

The math you actually feelPremiums are the steady drip. Deductible, coinsurance, and caps decide the bad-day damage. Lower premiums with a high deductible can be fine - until two medium bills arrive in one year. - Annual vs per-incident deductible: one big case vs several small ones changes which wins.

- Reimbursement percent: 80% of allowed charges, not always the whole invoice.

- Maximums: annual, per-condition, and lifetime caps end the conversation when reached.

- Fee inclusions: anesthesia, ER fees, hospitalization - confirm line by line.

Real moment: standing at the counter for a torn dewclaw estimate around $680, I opened two portals. Plan A: lower premium, $500 deductible, exam not covered. Plan B: higher premium, $250 deductible, exam in, 80% back. Same injury, different out-of-pocket. I didn't need a spreadsheet to feel which one fit my tolerance that day. Claims and support, not just benefitsSpeed and friction change your experience more than you think. I care about pre-approvals for expensive imaging, direct pay options, and whether the app asks me for the same records twice. - Average payout time: days, not weeks, is the bar.

- Direct pay: helpful if a $3,000 invoice would hurt your float.

- Pre-auth: clear guidance before big procedures prevents ugly surprises.

- Documentation: how many records and how often they ask again says a lot.

Red flags and green lights- Red: vague "customary charges," rising deductibles at renewal, exclusions tucked under definitions, long orthopedic waiting periods without waiver options.

- Green: transparent sample policy, exam fee coverage, lifetime illness coverage with no per-condition cap, orthopedic waiver with exam.

Questions to ask before you enroll- Is the deductible annual or per-incident, and do exam fees count toward it?

- What are the exact waiting periods, and can any be waived after an orthopedic exam?

- Are bilateral conditions treated as one?

- Any per-condition or lifetime caps on illness?

- How do you define pre-existing - sign, symptom, or diagnosis?

- Average claim turnaround, and do you offer direct pay to vets?

- How have premiums changed for this plan in my state over the last three years?

A practical way to choose- Pick a deductible you can pay today without stress; that's your reality anchor.

- Choose reimbursement that doesn't leave you queasy on a $2,000 bill.

- Set an annual max that covers your personal "worst case" for your breed and age.

- Run one sample claim from a real estimate - your next vaccine visit can give you line items to test.

- Read the policy PDF and search for "unless," "except," and "pre-existing."

- Call support once; if the answers feel slippery, believe that feeling.

Your decision lives at the intersection of budget, risk, and how you want a bad day to feel. Start, learn from your first claim, and adjust at renewal as your pet - and your experience - evolves...

|

|